Best Dividend Stocks to buy in November 2023

Several good quality stocks trading at a discount this month. I took advantage to diversify my portfolio by enhancing exposure to other industries.

In this series of articles called “Monthly buying sessions” I will show you how I make my investment decisions every month taking no more than 10 min a month. I will provide full transparency of my stock picks and show you real portfolio performance.

As usual I will start this article with a reminder of the assumptions of the 10-min investment method.

Assumptions

- I will invest $1,000 every month in Dividend Aristocrats stocks

- All dividends will be reinvested (Never use the automatic reinvestment tool offered by brokers)

- I will buy the best stock each month, except for diversification constrains once the portfolio starts to grow (we don´t want to concentrate too much risk in a few stocks)

Target companies aligned with my investment will meet below conditions:

- Pay interesting dividends yields (>3% depending on current market conditions)

- Have decent dividend growth ratios (ideally above inflation) and had been incrementing dividends for at least 25 consecutive years (All dividend aristocrats meet this last condition)

- Companies with reasonable payout ratios, since I focus on long term investments. Companies with high payouts are more likely to cut dividends that those with a reasonable one. (With exceptions, depending on the business sector, reasonable payouts are below 65%)

- Healthy business model. I won´t invest in companies with high debt ratios, nor companies with decreasing sales or profit margins. I will also avoid companies with known relevant legal issues until potential contingencies are cleared

Analysis

This is a great starting point since you have an updated list of dividend aristocrats, that includes several ratios I use for my analysis.

Looking at the 10 stocks with higher expected returns according to the analysts

At a first glance it was possible to see some interesting quality stocks trading at a discount and providing a dividend yield for those that is historically rarely to see about 3%.

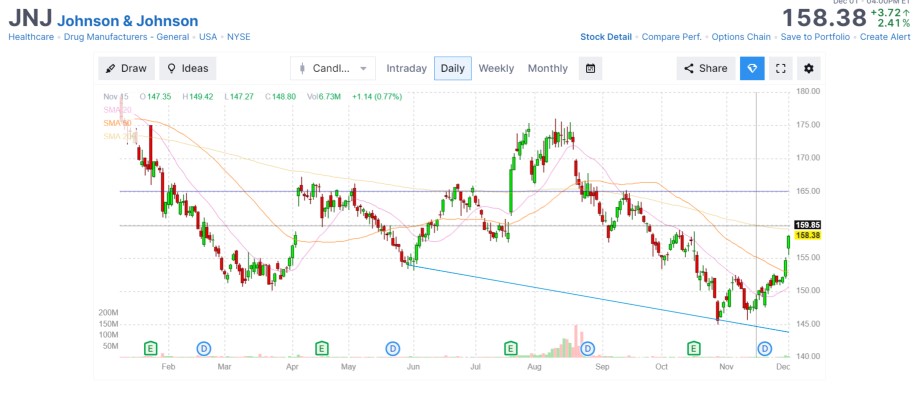

The best dividend aristocrat of the month for my portfolio was Johnson & Johnson. As you can see JNJ has an interesting dividend yield of 3,2%, which is rare to find.

What gives me piece of mind with Johnson & Johnson is that it is by far one of the most diversified and solid companies in the index and there is no reason to believe that it will continue to trade at a discount for a long time.

No more to say than to look to the impressive performance during the years and history of consistent growing dividend payments.

Another interesting stock that I picked this month for diversification purpose is NextEra Energy Inc.

NextEra is currently trading at 3,4% dividend yield and has an strong long term potential.

Conclusion

- Johnson & Johnson (JNJ), 6 stocks at $148,65 (3,2% dividend yield)

- Nextera Energy Inc (NEE), 1 stock at $57.19 (3,4% dividend yield)

Happy investments and see you for next month buying session!

Note for enthusiastic:

There are other tools that I have developed for myself that I do use to facilitate and speed up my stock picking process covering many other ratios and indicators I didn´t mention in this simplified analysis. Some of those are currently being enhanced and adapted to make it available to you on this website. If you like this article or are interested in receiving a notification when new tools or content is available register to our

newsletter at the bottom of this page (I don´t spam).

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as investment advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.