Home » 10 Min Dividend Investment Method

The 10-Minute Investment Method

10 Min Dividend Investment Method – Key highlights:

Simple Method to Generate Passive Income - How it works?

Our 10-Minute Investment Method is designed to make building wealth simple, reliable, and efficient. By investing in high-quality, dividend-paying stocks, you can create a steady income stream with minimal effort. Here’s how:

- Invest in Dividend-Paying Stocks every month

Focus on companies that pay regular dividends. Dividends provide a steady cash flow and let you enjoy the benefits of ownership without selling shares. - Focus on Safety and Growth

We prioritize companies with a strong history of dividend payments, especially Dividend Aristocrats—companies that have consistently increased their dividends for 25+ years. These stocks are known for their stability and reliable income. [Check the full list of Dividend Aristocrats here.] - Reinvest Dividends every month

Reinvesting dividends is key to compounding growth. It builds your share count over time, enhancing your returns and growing your income. Eventually, you may choose to live off dividends, but until then, reinvestment is key to accelerate portfolio growth. - Build a Well-Diversified Portfolio

Diversification across different sectors and companies adds stability and reduces risk, ensuring your portfolio isn’t overly dependent on any single stock or sector - Track your progress with ease

Our platform provides tools to help you monitor your portfolio, select the best dividend stocks each month, monitor dividend safety scores and track diversification.

All in one place in less than 10 minutes a month. You’re in control, making it easy to build confidence as you watch your portfolio grow steadily.What do you need?

- A brokerage account to trade U.S. stocks. (with the broker of your choice)

- A commitment to stay consistent and save money to invest every month. (It can be $500, $1000, $1500 or any amount you can commit with)

Start Early, Keep It Simple, and Focus on Growth

FREE 15 days Trial

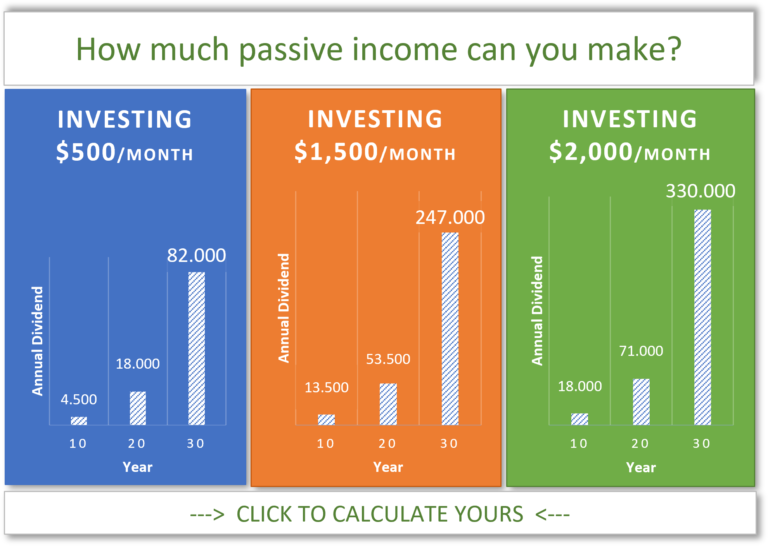

How much Passive Income can you generate?

Ever wondered when you could start living off dividends or covering a significant portion of your monthly expenses? Our exclusive Dividend Calculator can help you find out. With just a few details—like your age, monthly investment amount, and financial goals—our calculator will give you a personalized estimate of how soon you could reach financial independence with dividend income.

This tool is designed to make it easy (and even fun!) to see how small, consistent investments can grow into a substantial income stream over time. Test out different scenarios, visualize your future cash flow, and discover how close you are to reaching your financial goals with this simple, powerful tool.

Give it a try and see how much you could make with the 10-Minute Method!

FREE 15 days Trial

Main benefits of the 10 min investment method

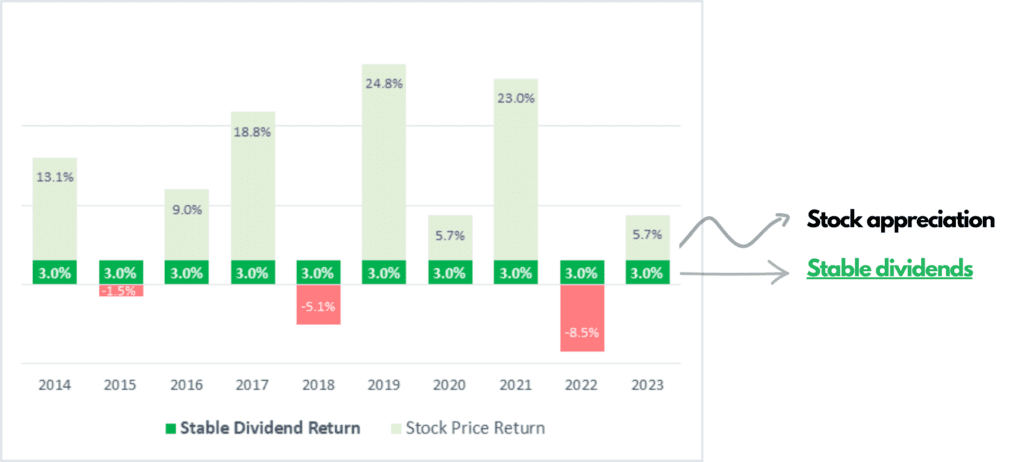

- Steady cashflow with less volatility

Dividend stocks offer regular income even during market downturns. Unlike other investments that may force you to sell at a loss to cover expenses, dividend stocks provide regular payments, allowing you to ride out market downturns without sacrificing your holdings. - Higher returns over time

Reinvesting dividends into a diversified portfolio of high-quality stocks can deliver higher returns with less volatility compared to broader market indices like the S&P 500. - Peace of mind

With a diversified portfolio of high-quality dividend stocks, you’ll benefit from consistent income to support your expenses. While some companies may cut dividends in challenging times, a well-balanced portfolio can minimize this risk and keep your cash flow stable.

This approach lets you build wealth over time with less volatility and a reliable income stream—giving you peace of mind, no matter what the markets are doing.

FREE 15 days Trial

Illustration of a typical quality dividend portfolio

Assumptions:

(1) Dividends are reinvested at a 4% avg. yield and 5% avg growth

(2) Portfolio value appreciation is not considered

The Power of Dividends

Dividends play an important role in generating equity total return. Since 1926, dividends have contributed approximately 32% of total return for the S&P 500, while capital appreciations have contributed 68%. Therefore, sustainable dividend income and capital appreciation potential are crucial factors for total return expectations.

Proven investment strategy

If you are interested in doing some research to understand what drives investment in high-quality dividend stocks to deliver higher returns with less volatility compared to the S&P 500, we encourage you to review the S&P 500 Dividend Aristocrats Report.

This report illustrates how a portfolio of high quality dividend stocks can blend capital growth with stable income, offering both growth and dividend income characteristics.

Start your journey to financial freedom