Best Dividend Stocks to buy in December 2023

Hello everyone! Here we are in the last stock buying session of the year.

As I always do, I will look for the best companies, with an eye on making sure my portfolio is properly diversified accross industries.

In this series of articles called "Monthly stock buying session", I will walk you thru my 10 min/month dividend investment method to generate a growing passive income flow to plan retirement and live off dividends. I will show you how I make my investment decisions every month taking less than 10 min and provide full transparency of my stock picks and show you real portfolio performance (something that nobody else does)

As usual I will start this article with a reminder of the assumptions of the 10-min investment method.

Assumptions

- I will invest $1,000 every month in Dividend Aristocrats stocks

- All dividends will be reinvested (Never use the automatic reinvestment tool offered by brokers)

- I will buy the best stock each month, except for diversification constrains once the portfolio starts to grow (we don´t want to concentrate too much risk in a few stocks)

Target companies aligned with my investment will meet below conditions:

- Pay interesting dividends yields (>3% depending on current market conditions)

- Have decent dividend growth ratios (ideally above inflation) and had been incrementing dividends for at least 25 consecutive years (All dividend aristocrats meet this last condition)

- Companies with reasonable payout ratios, since I focus on long term investments. Companies with high payouts are more likely to cut dividends that those with a reasonable one. (With exceptions, depending on the business sector, reasonable payouts are below 65%)

- Healthy business model. I won´t invest in companies with high debt ratios, nor companies with decreasing sales or profit margins. I will also avoid companies with known relevant legal issues until potential contingencies are cleared

Analysis

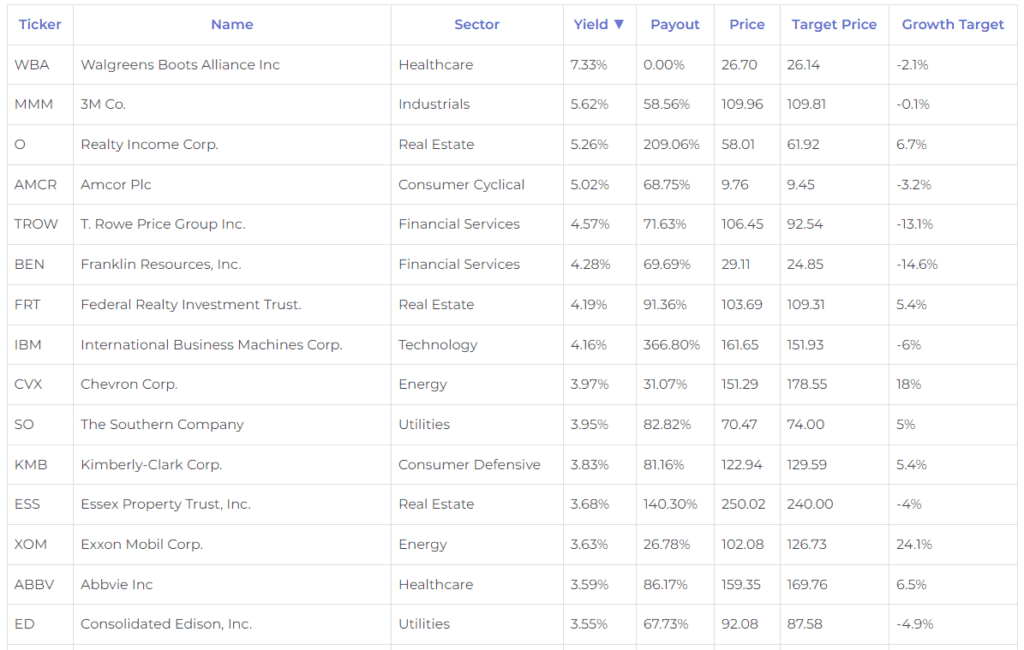

This is a great starting point since you have an updated list of dividend aristocrats, that includes several ratios I use for my analysis.

Looking at the top 15 dividend aristocrats stocks by yield and looking at the different historic performance

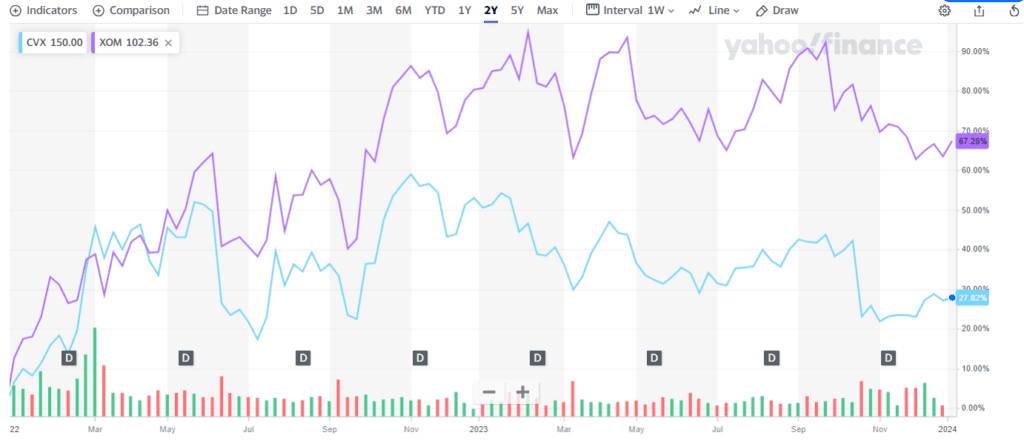

Both Energy giants have very similar ratios.

- Dividend yield is 3,97% for CVX vs 3,63% for XOM

- Payout ratios is 31% for CVX vs 26% for XOM

- Growth target price is 18% for CVX vs 24% for XOM

Therefore, we see XOM is slightly in a better position than CVX, except for the dividend yield and that is the reason why today I have decided to by

Conclusion

I cannot wait until January, which is a very special month for dividend aristocrats. January is the month when any changes to the 2024 list of dividend aristocrats will be announced, jointly with different announcements of dividend growth.

Note for enthusiastic:

There are other tools that I have developed for myself that I do use to facilitate and speed up my stock picking process covering many other ratios and indicators I didn´t mention in this simplified analysis. Some of those are currently being enhanced and adapted to make it available to you on this website. If you like this article or are interested in receiving a notification when new tools or content is available register to our newsletter at the bottom of this page (I don´t spam).

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as investment advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.